is an oversold stock bad

This as the name implies reflects a stock that appears to be worth more than the price it is trading at. 9 hours agoThere are only two technically attractive oversold stocks according to RSI this week Maple Leaf Foods Inc.

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

This scenario signals the end of short-term declines and the beginning of an upward rally.

. By Tezcan Gecgil InvestorPlace Contributor Jul 6 2022 647 pm EDT. When a stock is oversold it trades at a price below its intrinsic value. 12 hours agoVolatility and uncertainty are reduced.

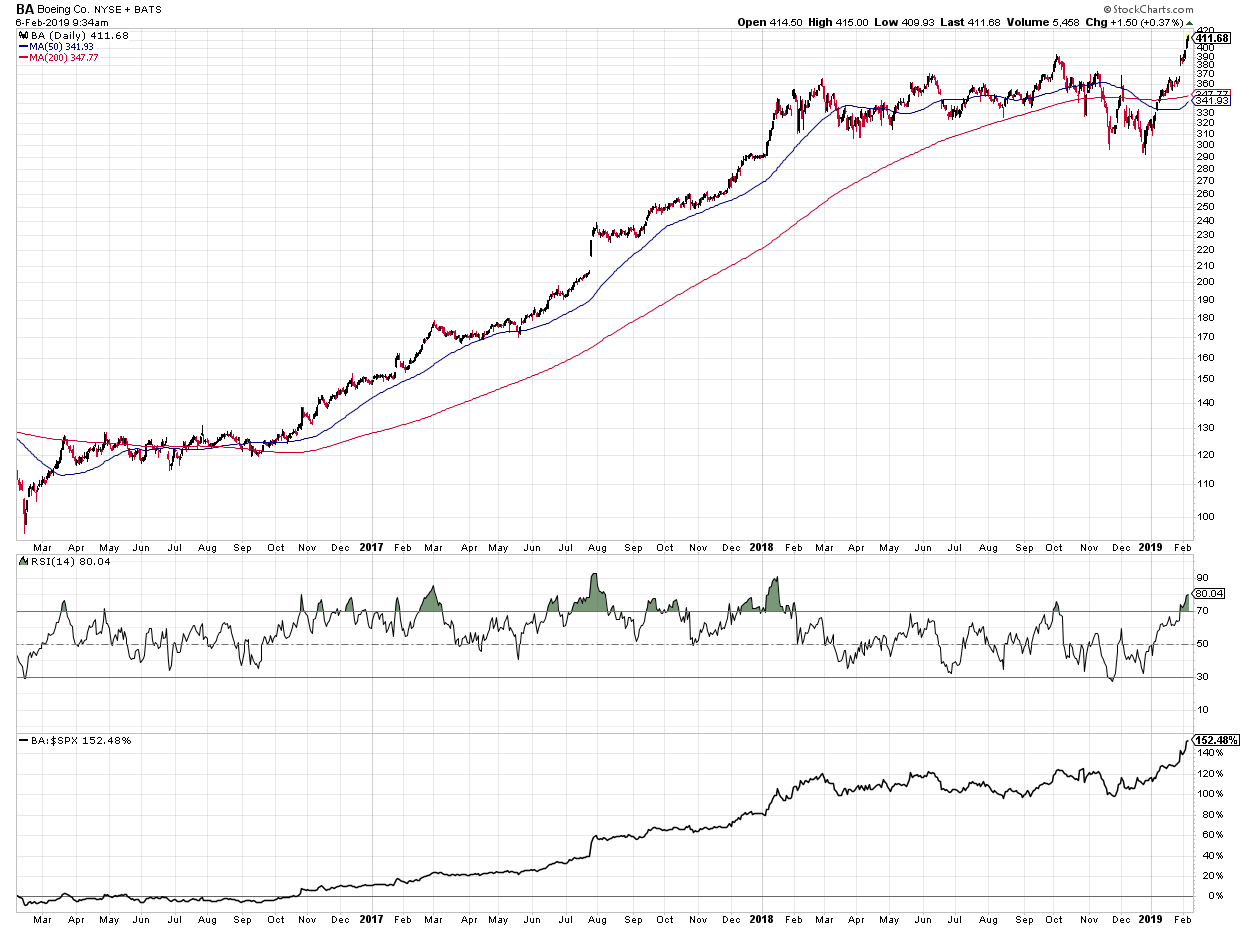

There are a few best-in-class bank stocks out there that are set to surge. And Rogers Communications Inc. The RSI is a technical analysis momentum indicator which displays a number from zero to 100.

An oversold period can happen immediately after a financial asset makes a parabolic dip. As a result it causes the price of the share to drop. Usually an RSI below 30 indicates an oversold stock.

Thus if IBM has an RSI of 25 you can assume that the shares are very likely to rise from current levels. Roku stock fell by 11 over the last three trading days following its weaker-than-expected Q2 2022 earnings report taking its year-to-date decline to. As opposed to overbought oversold means that a companys stock price has decreased substantially.

Now this can be for a number of reasons but the most common one is that theres been a major sell off on the back of bad news. Often this is because there are legitimate concerns about the business. Here are seven oversold stocks that stand out as compelling opportunities in July.

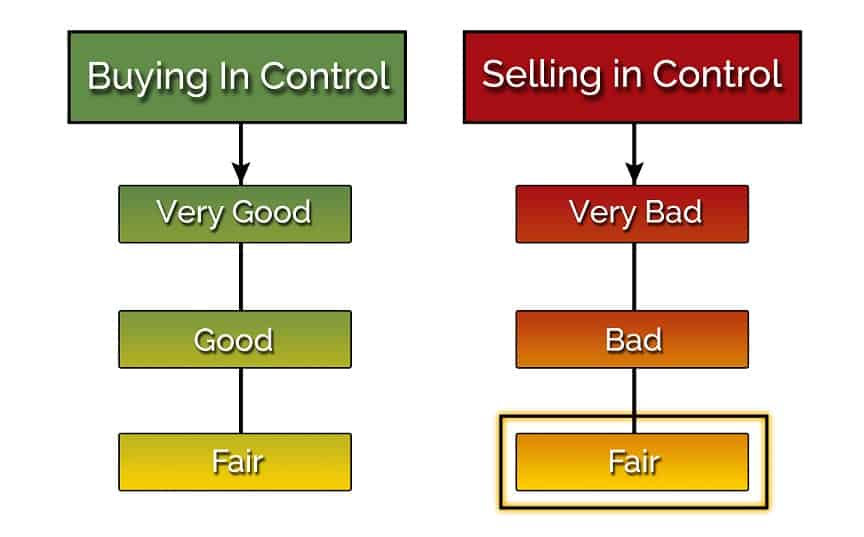

As the market is always right there are factors not known to everyone causing. Generally an oversold stock suffers from overreacting traders. If a stock has dropped in price because of bad earnings or new products from the competition the price decline is explainable.

Now this can be for a number of reasons but the most common one is that theres been a major sell off on the back of bad news. Cramer says stocks are still badly oversold even after Wall Streets big rally. The first time was in 2004 when the stock.

Therefore an impending price bounce is highly likely. The list of overbought technically vulnerable stocks. An oversold level is the exact opposite of being overbought.

It refers to a situation where the price drops too much such that close watchers start thinking that it has been oversold. Bausch Health Companies TSXBHC NYSEBHC is currently seeing its stock decimated for the third time in the last two decades. Any level below 30 is oversold while an RSI of over 70 suggests the shares are overbought.

For the retail investor buybacks lower trading costs and reduce downside risk. The share price would go on to rise from under 36 up to a. Investors are increasingly looking to buy.

This is good for some bad for others or even neutral. The lower the value of the index the more oversold the stock is. SOPA ImagesLightRocket via Getty Images.

Still while stocks including oversold names may not have fully bottomed-out you may still want to buy. There has been too much selling and anyone. Often this is because there are legitimate concerns about the business fundamentals but other times the overselling is the result of a storm in a.

When a stock becomes oversold though its a good thing for new investors. Was even more oversold at the time as the stock was at an RSI level of just 26. Suppose a stock value suddenly falls because of issues in the company bad reports or any mass withdrawals of traders believing that the stock may be overpriced.

When a stock is oversold parties offer the stock beyond the fair value the true value is hard to gauge because everyone calculates differently. You can buy the stock and sometimes see quick returns as it rebounds. The stockprice to dip below the fair value.

An oversold condition in shares is typically considered to occur when there are more sell orders for a companys stock than buy orders. The stocks that arrived at the lower price point are no longer equal to their original value. 1 day agoA healthcare stock.

CNBCs Jim Cramer said Thursday that trying to get into. Bank stocks are oversold and could be beneficiaries of interest rate hikes. The most undervalued stocks in Canada.

Buybacks efficiently reallocate capital as well as reduce risk and improve. Oversold stocks are undervalued. However this does not mean that investment into that particular stock is inherently bad.

When a particular market instrument is sold continuously investors think the assets price has hit rock bottomthe asset becomes oversold. In fundamental analysis such a situation is known as being undervalued. It may take time for these seven oversold stocks to.

Like an overbought stock is not necessarily bad the existence of an oversold condition does not mean that the stock is a good stock. As opposed to overbought oversold means that a companys stock price has decreased substantially. The opposite of an overbought stock is an oversold stock.

It simply means that the stock is generally seen as a good value at this particular time.

:max_bytes(150000):strip_icc()/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

Overbought Vs Oversold And What This Means For Traders

Which Indicators Can I Use To Define Overbought And Oversold Mailbag Stockcharts Com

Bad Overbought Or Good Overbought The Mindful Investor Stockcharts Com

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

Oversold Stocks Intraday Marketvolume Com

Determining Overbought And Oversold Conditions Using Indicators

Best Oversold Stocks To Buy Now For June 2022

Market Oversold The Best Way To Tell If The Market Is Oversold

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

Oversold Stocks Short Term Marketvolume Com

Oversold Stocks In 2022 Learn More Investment U

Best Oversold Stocks To Buy Now For June 2022

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

What Does An Oversold Stock Mean Would It Be A Good Buy Quora

/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)

/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)